- Featured Interviews

- July 6, 2020

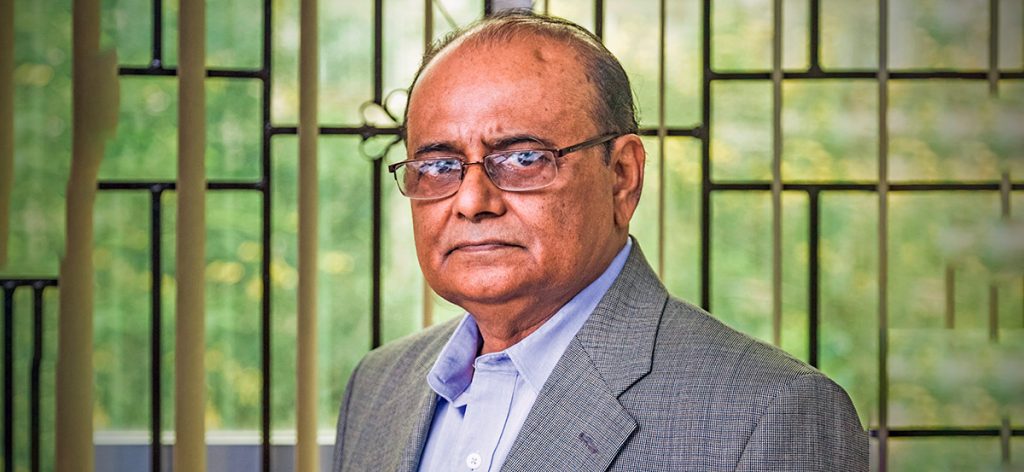

ZAIDI SATTAR, Chairman, Policy Research Institute

ZAIDI SATTAR, Chairman, Policy Research Institute

A TIME OF TRIALS & TRIBULATIONS

As economies around the world face perilous times, Dr. Zaidi Sattar advises on the need to keep trade and investment policies open and welcome foreign direct investment, not just in words and on paper, but in action and, most importantly, in our mindset.

Briefly, how do you summarize the impact of COVID 19 on Bangladesh’s trade prospects?

First of all, Covid-19 is by far the worst health crisis of our lifetime. But its impact is not limited to health alone. It has become a health-cum-economic shock of global magnitude. Perhaps financial and economic globalization and the inter-connectedness of peoples across the world have a role to play in making this a global pandemic rather than just a regional or national outbreak. Until the Covid-19 pandemic hit in March 2020, the Bangladesh economy was averaging 7-8% GDP growth during much of the decade of the two five-year Plans (i.e. 6th and 7th Plans), between FY2011 and FY2020. Global output and trade are both casualties of this pandemic. With the negative shock of the pandemic, Bangladesh exports are expected to decline by 20% in FY2020 with imports falling about 12% year-on-year. The Government is still optimistic about a strong post-COVID-19 revival, projecting GDP growth of 8.2% in FY2021 compared to only 5% in FY2020, with export and import growth back in 15% growth territory. These are highly optimistic scenarios. What can be said with certainty is that revival of the domestic economy will not be enough to dig the economy out of the COVID-19-induced coma, leveraging global demand through exports and trade will have to be a major lifeline for any projected recovery. As the global economy wakes up from the slumber of COVID-19, Bangladesh will need more robust trade policy and export orientation to make any headway in FY2021 and beyond. Business, as usual, is not an option if the robust economic recovery is the goal.

Do we have economic policy solutions to the COVID-19 pandemic?

Given the unprecedented nature of this global health-cum-economic crisis, it would be cavalier for anyone to presuppose that textbook economic policy would have all the answers. We should have the wisdom to accept that, even with the best science, there is no such thing as perfect knowledge and optimal solutions. I think first of all we economists should have the humility to acknowledge the unforeseen nature of the challenge at hand and to say that though we do not have all the crisp and clear recipes, we can suggest the general direction that macroeconomic and sector policies should take. We also need to acknowledge that our Government, which is just as aware of the intensity of the unfolding crisis as we are, has adopted a proactive stance with a package of policies that is generally in the right direction. Surely, more can be done with more financial resources levelled at the crisis over time. These are desperate times calling for out-of-the-box policies. No stone should be left unturned.

Despite being re-opened, shops across the country are yet to see regular sales. How long do you think it will take for consumer spending to normalise? What should be the survival strategy till then?

The COVID-19 infections have followed a familiar pattern across countries. Infections reach a peak and then, if social distancing and other control measures are properly adhered to, the rate of infections, and hospitalizations, start to decline and then taper off. That is when economic activities can start resuming and shops and offices open up. In Bangladesh, the COVID-19 infections and hospitalizations are still on the rise, indicating that the apex is probably around August. So retail sales will start getting normal after that period. In the meantime, the strategy that the world has come to accept – and all health experts recommend – is to practice work-from-home and shelter-at-home. The Government has a major role to play by providing adequate financial support to the poor and those out of employment. Post-pandemic economic recovery will take concerted efforts and robust policies. Budgetary deficits in these times should not be of any concern, for now, say leading experts around the world.

The RMG sector covers more than 85% of our exports and is the backbone of our economy. What can be done to stop/reduce the indiscriminate order cancellations from the buyers? Why is export diversification not happening?

COVID-19 pandemic that prompted lockdowns and disruption of economic activity globally has resulted in the collapse of retail sales and retail activity in Bangladesh’s major export markets. That prompted order cancellations one after the other. In a world economy where Bangladesh exports have a negligible share of the market, our exporters have little or no “pricing power” or any control over managing demand. But RMG is a different case, now that Bangladesh has become the second-largest exporter of RMG commanding 6.5% of the global RMG export market. Bangladesh exporters do have some influence though nothing like China which has a market share of 35%. BGMEA has been proactive in approaching Government agencies and business associations in destination countries to intervene and ensure a sense of proportion and a good understanding of the income and employment effects of arbitrary order cancellations. Mutually beneficial temporary postponement of orders would be the better option for all concerned.

The current debacle also draws attention to the challenge of export diversification in Bangladesh. Recognizing the vulnerability associated with an export concentration in RMG, Government policy has repeatedly and strongly emphasized export diversification as a priority goal, highlighting a long list of non-RMG products that will be receiving government support for their expansion. But apart from an occasional reference to reducing an input tariff or raising an output tariff, ostensibly to protect an industry, what is conspicuously missing is a concerted trade policy program of setting the balance of incentives right. PRI research has demonstrated why this does not work. All of the non-RMG products cited (e.g. footwear, plastics, electronics, agro-processing, furniture, etc.) are import substitutes which are highly protected in the domestic market with the highest rates of tariffs and para-tariffs, making their domestic sales far more lucrative than exports –case of anti-export bias of the extreme kind. Why would these entrepreneurs consider exporting when the domestic market gives them much higher profits?

The biggest challenge in Bangladesh’s trade policy is to rationalize protective tariffs strongly enough to at least make relative incentives between exports and domestic sales equally profitable. Only then can we have some traction in export diversification.

Will exchange rate management be a critical component of trade policy to fuel economic recovery?

What is often ignored is that the exchange rate – Taka price of foreign exchange – happens to be a pivotal component of trade policy. The system of fixed exchange rates has long been abandoned around the world shifting in favour of flexible exchange rates. Economies that have achieved export success have all shown one common trait – they strictly avoided overvaluation of their currencies and often chose to keep their exchange rates depreciated. Bangladesh floated its exchange rate in 2004. But, like most countries, it stuck to a regime of “managed float”, where the Bangladesh Bank strictly monitors the movement of the exchange rate and intervenes, apparently to keep the nominal exchange rate from depreciating too much too fast (i.e. more Taka per US dollar). PRI research has shown, in many write-ups, how that real effective exchange rate (REER) has significantly appreciated over the past five-plus years undermining export competitiveness. Exporters suffered as they were not getting a decent taka value of their export sales. The current policy of 1% cash incentive to RMG exporters and 2%incentive for remitters are no match to, say, a 5-10% depreciation of the exchange rate that has remained steady at Tk.84.5-85.0 per US$ since January 2019.

It is important to note that 5-10% depreciation of the exchange rate is equivalent to a 5-10% cash subsidy to all exports and remittances, across the board, and the cash subsidy does not have to come out of the budget, unlike the cash subsidy. PRI research has also shown the way to counterbalance any inflationary effects of such a depreciation, by downward adjustment of tariffs without affecting customs revenues. As for the final argument that such depreciation will raise the cost of external debt financing, may I add that our external debt servicing rate is a mere 4% of our foreign exchange earnings, which will not change, except that Taka fiscal cost may rise 5-10% — a minor irritant for an economy whose low level of indebtedness has been recognized recently by The Economist (Bangladesh was ranked 9th among the least indebted countries of the world).

Export earnings from jute and jute products have increased by 14 percent in the first ten months (July-April) of the current fiscal year, taking the second position in the country’s export trade? What are the factors that have contributed to this accomplishment? What can be done to ensure a revival of the golden era of jute in Bangladesh?

After RMG, exports that have the potential of exceeding $1 billion a year include jute and jute products (e.g. jute twine and yarn) which have shown to be in the lead. Among the non-RMG exports that we can count on for the future, jute and jute products remain highly prospective, primarily because jute is a natural fibre and there is a consumer preference for natural (eco-friendly) over artificial fibres now. Jute products have a future, but it needs research and innovation to come up with new products to meet the demand and preferences of consumers today. That cannot happen through state-owned enterprises. It requires a huge amount of research and development (R&D) resources but the initiative has to be led and managed by private enterprises. The fact that a big chunk of our industry is still owned and operated by public entities is a drag on the industry. Indeed, the future holds all the prospects of jute becoming the “golden fibre” again, but two things must be ensured: (a) adequate quantum of R&D resources made available to private enterprises from the public exchequer, and (b) privatization of all SOEs in the jute industry. With that, there will be no stopping the jute sector from becoming the “golden fibre” industry of the future.

As the relation between China and the West deteriorates more and more companies are leaving the country. How can Bangladesh attract these departing companies as an alternative manufacturing hub?

I am no expert on geopolitics. My informed guess is that this is a temporary phenomenon. And the dispute is not between China and the West, it is an artificial trade conflict raised between China and the United States. China and the West have to work together for a better future for mankind. For all its shortcomings, globalization — an increasingly interconnected world marked by greater flows across borders of workers, tourists, ideas, emails, oil and gas, television and radio signals, data, migrants and refugees, viruses (computer and biological), environment polluting carbon dioxide and other gases, manufactured goods, food, dollars and other currencies, tweets, and a good deal else – is one of the defining realities of modern existence. It is an irreversible phenomenon of modern times. The interconnectedness of economies and societies has become more permanent than anyone can imagine. What enterprises leave China will find berthing in economies like Bangladesh, Vietnam, and the rest. With the onward march of technological transformation and industrial evolution, China will be shedding industries as its wages and labour-cost rise. China, the world’s factory, will soon become the world’s service hub as its services sector rises to over 70% of GDP, as the economy overtakes the USA by 2030 to become No.1. China’s consequent de-industrialization trend will be a boon for economies like Bangladesh. We need to keep trade and investment policies open and welcome foreign direct investment, not just in words and on paper, but in action and, most importantly, in our mindset. Then there will be no dearth of investment inflows from other shores on to ours.

https://ibtbd.net/dr-zaidi-sattar-chairman-policy-research-institute-2/