Banking sector reforms between 1997 and 2012 vastly improved the banking landscape of Bangladesh, converting the sector from an unhealthy public sector dominated enterprise to a more healthy, private sector-dominated competitive industry. This transformation played a key role in enhancing private investment, exports and GDP growth, which helped Bangladesh to climb from a low- income economy to a lower-middle-income country and set the stages for an aspiration to attain upper-middle-income country (UMIC) status by 2031.

The feasibility of this optimistic 2031 milestone hinges on the ability to implement reforms throughout the economy. Instead, progress is being challenged by ongoing serious macroeconomic instability. In banking, drift in policy making since 2012 has created substantial negative pressure on the health of the banking sector. This in turn is complicating the restoration of macroeconomic stability and jeopardising the restoration of the UMIC growth path.

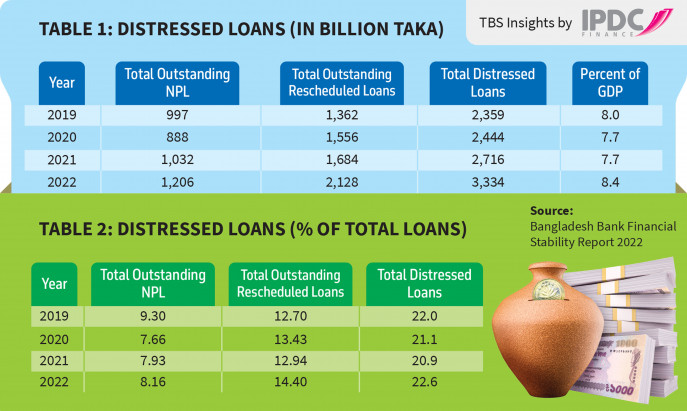

The deteriorating health of the banking sector is illustrated by the growing share of distressed loans in the portfolio of the banking sector. Distressed loans comprising non-performing loans (NPL) and restructured/rescheduled loans (RL) are rising as a share of total loans (Tables 1 and 2). In taka terms, the total outstanding distressed loans reached Taka 3,334 billion (8.4% of GDP) in 2022.

Infograph: TBS

Data for the total volume of stressed loans in 2023 are not yet available. However, industry experts expect this to go up. Indeed, the volume of NPL did increase from taka 1,206 billion in December 2022 to Taka 1,456 billion in December 2023, which is a hefty 21% increase in NPL and amounts to 9% of total outstanding loans.

The Bangladesh Bank (BB) is rightly concerned about this problem of growing incidence of distressed loans, especially the rising NPL trend. To address this problem, the BB has recently announced a NPL reduction road map that seeks to achieve three objectives: (i) reduce total banking sector NPL from 10.1% in FY2023 to below 8% by end of FY2026; (ii) lower the NPLs of the state-owned banks and private commercial banks from 25% and 6.5% respectively in FY2023 to 10% and 5% respectively by end of FY2026; and (iii) to ensure good governance in the banking sector with a view to eliminating bad lending decisions by the end of FY2026.

The BB roadmap consists of 17 planned actions, of which some 11 are aimed at lowering NPL and six are intended to improve corporate governance. Important elements of the Action Plan to reduce NPL include allowing banks to write off a bad loan after two years with 100% provisioning instead of waiting for three years; establishment of a “Write- Off Loan Recovery Unit” under MD oversight and reflection of progress on MD performance; establishment of Asset Management Company in the private sector for discounted purchase of bad loans from banks; disallow unrealised interest income in the income statement and instead show accrued interest on stressed assets as a separate item in the balance sheet; no extension of deadlines for restructured loans; and several improvements in prudential regulations to improve loan classification, loan recovery, proper valuation of loan collaterals, and capacity of the bank’s legal team to pursue loan recovery.

Elements of the Action Plan to improve corporate governance of the banking sector include strengthening of the fit and proper test for selection of bank board members; stronger role and incentives for independent directors; strengthening the selection process and performance appraisal of bank MDs; tightening single borrower exposure limit; provisions for merger of weak banks with strong banks; and enhancing training of bank officers.

The adoption of this road map is laudable, and BB should be congratulated for initiating this. Several observers have already noted that the main challenge BB will face is to ensure that the road map is properly implemented. It was also pointed out that similar reforms were announced earlier but implementation results were not encouraging. BB would be well advised to take these concerns positively, rather than as criticism, carefully assess the experience of past implementation constraints and develop an implementation strategy that seeks to overcome those constraints.

Quite apart from these well-intentioned observations, an important question to ask is how adequate is this Action Plan to address the menace of distressed loans? In order to answer this question analytically, it is necessary to distinguish between the two inter-related but distinct aspects of NPLs (and by extension the RLs): (i) the stock of NPL and (ii) the flow of NPL. The only sustainable way of reducing the stock of NPL over time is to reduce to a minimum the flow of NPL.

Reducing the Flow of NPLs: In a market economy as in Bangladesh, even with the best lending decisions, some loans may get distressed owing to unanticipated deterioration in market conditions. There are some elements of this factor, but most of the NPL and RL in Bangladesh are caused by poor governance. This is evident from the fact that the incidence of NPLs is most severe in state-owned commercial banks (SoCBs), followed by private commercial banks (PCBs) and lowest among foreign commercial banks (FCBs). It is also well-known that SoCBs are infested with severe governance challenges including political interventions in lending decisions, loan restructuring and loan recovery. PCBs in theory have better protection from governance problems and political interference but evidence from the experience of several banks shows otherwise. FCBs, however, are fully shielded from local governance challenges and political interventions because these are managed with strong oversight from foreign corporate headquarters. The NPL ratio in the FCBs, which is below 5%, sets the standards for ensuring a governance free banking sector in Bangladesh.

The Action Plan for improvement of the banking sector governance falls short in a major way in that there is very little discussion of how the governance structure of the SoCBs will be reformed to avoid the future growth of NPLs. The only sustainable way to reduce NPLs and RLs in SoCBs requires that these banks must be converted to profit-making enterprises with professional board and management. They must be fully supervised by BB and subject to full regulatory and prudential norms with compliance within a reasonable but strict timeline. There can be no political interference in lending decisions or loan repayment terms. BB needs to think through carefully if the SoCBs governance reform challenge is adequately addressed by the Action Plan.

The use of prudential norms (presently guided by Basel III) is intended to help BB to properly assess the risks to the banking sector and take actions to mitigate those risks. A high and growing share of NPL is a signal that the concerned bank is not managed well, and BB intervention is needed. The most direct and sustainable way to reduce NPL is to prevent a problem bank from engaging in new lending until such time that it is able to fully meet all prudential norms. BB data shows that as of June 2023, there were 16 banks where NPL incidence exceeded 10% and 9 banks where NPL ratio exceeded 20%. Most of these problem banks also did not meet the Basel III capital adequacy norm. The best way to reduce the NPL ratio and lower the risk to the banking sector would be to restrict these non-compliant banks from new lending until such time that they are able to restore compliance with the Basel III capital adequacy norm and reduce the NPL to below 10%.

A concern raised by BB officials about this prudentially sound policy is that restrictions on new lending would hamper the ability of the banks to service their obligations to depositors and finance their operational costs. But this need not be the case. Problem banks cannot lend and take additional NPL risk, but they can invest in safe assets such as T-bills. Additionally, the reform is intended to create an incentive system that engages the attention of bank owners to behave responsibly and be accountable for their bad behaviour.

BB is presently implementing the banking prudential norms under Basel III. Proper implementation of Basel III prudential standards requires adoption of internationally acceptable accounting standards, proper valuation of all banking assets and liabilities, proper estimation of risk-weighted capital and proper definition of asset qualities as per Basel III specification. BB needs to assess if these standards are met by all banks in determining the values of risk-weighted capital and NPL Industry experts believe such an assessment would likely lead to an increase in true NPL and a reduction in actual risk-weighted capital, which then needs to be built in setting the proper targets for the NPL Reduction Action Plan.

Addressing the NPL Stock Problem: The proposed NPL Reduction Action Plan is stronger in seeking to reduce the stock of NPL. But, as noted, unless the NPL flow problem is addressed first, any improvement in the reduction of the stock of NPLs will be temporary because the flow of new NPLs will soon overwhelm any reduction in the stock. Additionally, the implementation of the reduction plan for the stock of NPLs must be carefully designed and monitored. Top priority should be given to clearing the legal hurdles to loan recovery and fast tracking such recovery through special provisions vetted through the Supreme Court. Careful attention should be given to the proposed setting up of an Asset Management Company. In Bangladesh, where governance in both public and private sector is a challenge, the setting up of an Asset Management Company without proper safeguards presents severe risks. Technical advice from the World Bank and the IMF drawing on good practice international examples would be necessary. No public money or guarantees should be provided. Similar prudential attention should be given to the proposal to allow bank mergers, with implementation guided by international professional advice and good practice global experience.

Sadiq Ahmed is Vice Chairman of the Policy Research Institute of Bangladesh. He can be reached at sadiqahmed1952@gmail.com